The Wealth Shift No Economist Wants to Talk About

A hidden wealth shift is reshaping economies, moving power from wages to assets and inheritance—quietly redefining opportunity, inequality, and the future.

Introduction: The Quiet Redistribution Reshaping the World

For decades, economists have warned about inequality, debated tax policies, and tracked the widening gap between the rich and the poor. Yet beneath those familiar conversations, a far more disruptive wealth shift has been unfolding—one that rarely appears in official forecasts or academic panels. It isn’t just about billionaires getting richer or wages failing to keep up with inflation. It’s about where wealth is moving, who controls it, and why traditional economic models struggle to explain it.

This silent redistribution is not happening through dramatic crashes or revolutions. Instead, it’s advancing quietly through asset ownership, demographic change, technological power, and the erosion of middle-class stability. And while economists may acknowledge fragments of it, few openly confront its full implications.

Context & Background: How Wealth Traditionally Moved

Historically, wealth transfer followed predictable paths. In the post–World War II era, industrial growth, strong unions, affordable housing, and expanding education systems allowed wealth to flow downward and outward. Middle classes expanded, homeownership increased, and generational mobility seemed achievable.

Later, globalization reshaped that balance. Manufacturing moved offshore, financial markets grew more complex, and capital began to outperform labor. Still, most economic discussions framed wealth shifts as cyclical—something that policy adjustments or market corrections could fix.

But today’s wealth movement is structurally different. It is less visible, more concentrated, and increasingly detached from productivity or wages. Instead of circulating through broad populations, wealth is consolidating into specific assets, institutions, and demographics.

Main Developments: What’s Really Changing—and Why It Matters

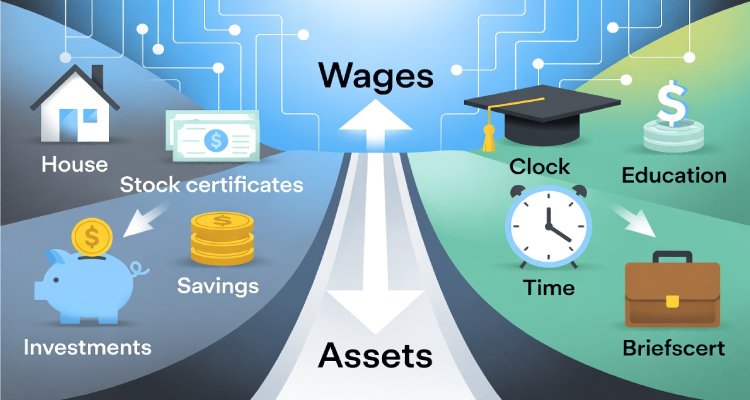

1. Wealth Is Shifting From Labor to Assets

The most significant shift is from income-based wealth to asset-based wealth. Salaries, even for skilled professionals, rarely grow as fast as assets like real estate, equities, private equity stakes, and intellectual property.

Those who already own assets see their wealth compound. Those who rely solely on wages fall further behind, even when employed full-time. This dynamic has created a growing class divide between asset holders and non-asset holders—one that traditional employment statistics fail to capture.

2. Generational Wealth Is Becoming the Primary Advantage

Another uncomfortable reality: inheritance now matters more than effort in many economies. Younger generations face higher housing costs, student debt, and unstable employment, while older generations hold a disproportionate share of property and financial assets.

As wealth concentrates within families rather than flowing through wages, economic mobility slows. Opportunity increasingly depends on timing of birth, not talent or education.

3. Digital Capital Is Outpacing Physical Economies

Technology has introduced a new form of wealth: digital leverage. Platforms, data ownership, algorithms, and intellectual property can generate enormous returns with minimal labor input.

A small number of individuals and firms control systems that scale globally without proportional job creation. Traditional economic tools—focused on employment, output, and consumption—struggle to measure this concentration accurately.

4. Inflation Has Accelerated the Divide

Inflation affects everyone, but not equally. Rising prices erode savings and wages, while asset owners often see values rise alongside inflation. As a result, inflation has quietly acted as a transfer mechanism—moving purchasing power away from those who spend most of their income toward those who hold appreciating assets.

Expert Insight & Public Reaction: Growing Unease, Few Answers

Some economists privately acknowledge that current models underestimate asset-driven inequality. Analysts point out that GDP growth can look healthy even as living standards stagnate for large portions of the population.

Public sentiment reflects this disconnect. Surveys consistently show that people feel the economy is “doing well” for corporations and investors but not for households. Trust in institutions—financial, political, and academic—has weakened as lived experience diverges from official data.

Social media and independent researchers have amplified these concerns, challenging narratives that frame economic strain as temporary or individual failure rather than structural imbalance.

Impact & Implications: Who Is Affected—and What Comes Next

Middle-Class Erosion

The middle class, long considered the backbone of stable economies, is being hollowed out. Without access to appreciating assets, many households hover one crisis away from financial insecurity despite steady employment.

Policy Limitations

Governments face mounting pressure but limited tools. Interest rate adjustments, stimulus packages, and tax reforms often fail to address asset concentration directly. Worse, some policies unintentionally reinforce it.

Social and Political Consequences

Unchecked wealth consolidation risks more than economic imbalance. It fuels political polarization, generational resentment, and declining faith in meritocracy. When people believe the system no longer rewards effort, social cohesion weakens.

A Redefinition of “Wealth”

Wealth is no longer just money—it’s access. Access to capital, data, networks, and ownership structures increasingly determines who thrives in modern economies.

Conclusion: The Conversation Still Waiting to Happen

The most unsettling aspect of this wealth shift is not its scale, but its silence. While headlines focus on markets, elections, and inflation rates, the deeper redistribution continues largely unchallenged.

This is not a warning of imminent collapse—but it is a signal of long-term transformation. Until economists, policymakers, and institutions openly address how wealth is truly moving—and who is being left behind—the gap between economic theory and lived reality will only grow.

The wealth shift no one wants to talk about may ultimately define the next era of global stability—or instability.

Disclaimer :This article is for informational and educational purposes only. It does not constitute financial, investment, or economic advice. Readers should consult qualified professionals for personalized guidance.