How Startups Are Monetizing Assets You Didn’t Know You Owned

Startups are quietly turning your data, behavior, and digital assets into revenue. Here’s how everyday ownership is being monetized without you noticing.

Introduction: The Invisible Assets You Carry Every Day

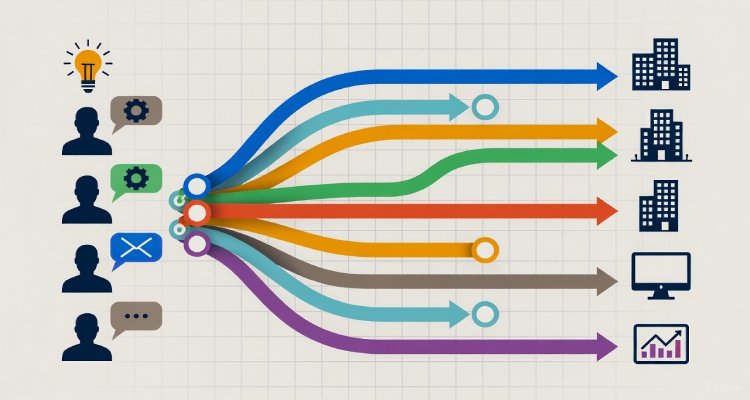

You may not own a house, stocks, or rare collectibles—but you almost certainly own something far more valuable than you realize. Every swipe on your phone, every mile you walk, every preference you express online quietly generates assets that startups are racing to monetize. These are not physical possessions, yet they hold immense economic power.

From personal data and digital behavior to biometric signals and unused digital rights, startups across the globe are building businesses around things individuals technically own—but rarely control or profit from. What was once considered digital exhaust is now a currency, and an entire startup ecosystem is emerging to capture its value.

Context & Background: When Ownership Became Abstract

Ownership has evolved dramatically in the digital age. In the industrial era, value was tied to land, labor, and machinery. Today, it is increasingly linked to information, identity, and attention. Smartphones, wearables, smart homes, and online platforms continuously produce data points that map who we are and how we live.

For years, large technology companies dominated this space, collecting and monetizing user data at scale. But a new generation of startups is pushing the boundaries further—finding ways to extract value from assets people rarely recognize as “owned,” such as browsing habits, location patterns, voice samples, health metrics, and even idle computing power.

This shift is happening quietly, often hidden behind friendly app interfaces, free services, and long consent forms few users read.

Main Developments: What Startups Are Monetizing—and How

Personal Data as a Product

One of the most lucrative assets is personal data. Startups are building platforms that aggregate anonymized consumer behavior—shopping preferences, content engagement, lifestyle patterns—and sell insights to advertisers, insurers, and financial firms. While users technically own their data, startups often secure usage rights through terms of service that grant broad permissions.

Attention and Behavioral Patterns

Time spent scrolling, pausing, or reacting is no longer just engagement—it’s monetizable intelligence. Behavioral analytics startups convert attention patterns into predictive models that help brands influence purchasing decisions or tailor content for maximum impact.

Health and Biometric Signals

Wearables and fitness apps collect heart rates, sleep cycles, movement patterns, and stress indicators. Startups analyze this data to create wellness scores, insurance risk models, or corporate productivity insights—often without users realizing the downstream applications of their own biometric information.

Digital Identity and Reputation

Your online identity—reviews you write, ratings you give, networks you build—has economic value. Some startups package digital reputations into trust scores for lending, hiring, or background screening, monetizing credibility that individuals unknowingly generate over years.

Idle Assets You Didn’t Know Existed

Certain startups even monetize unused digital resources, such as spare internet bandwidth, unused cloud storage access, or dormant processing power on personal devices. What feels like digital inactivity becomes a distributed asset class.

Expert Insight: “Ownership Without Control”

“People assume ownership means authority, but in the digital economy, ownership often exists without control,” says a digital rights analyst tracking platform economics. “Startups aren’t stealing assets—they’re structuring consent in ways that favor monetization over user awareness.”

Technology ethicists note that many startups operate in regulatory gray areas, where consent is legally valid but ethically questionable. Public sentiment is increasingly uneasy, especially as consumers realize how deeply personal data is embedded in profit models.

At the same time, some founders argue they are unlocking value users never accessed before, creating efficiency and innovation rather than exploitation.

Impact & Implications: Who Benefits—and Who Pays the Price?

Consumers

For individuals, the impact is double-edged. On one hand, free apps, personalized services, and smart technologies improve convenience. On the other, users rarely share in the profits generated from their own digital assets.

Startups and Investors

For startups, monetizing invisible ownership is a goldmine. Low acquisition costs, scalable data models, and recurring revenue streams attract significant venture capital. The business case is strong—especially where regulation lags behind innovation.

Regulators and Policymakers

Governments are now grappling with how to define ownership in a digital context. Data protection laws, consent frameworks, and digital property rights are evolving, but enforcement remains inconsistent across regions.

The Future Marketplace

A growing movement advocates for “data dividends” and user-owned data platforms, where individuals can license their information directly. If adopted at scale, this could reshape the balance of power between users and startups.

Conclusion: The Price of Not Knowing What You Own

The modern economy runs on assets that are intangible, invisible, and often misunderstood. Startups are not creating value from thin air—they are discovering it in places consumers never thought to look. The real question is not whether monetization will continue, but whether ownership will eventually come with transparency, control, and compensation.

As awareness grows, so does the possibility of a future where people don’t just generate value—but participate in it knowingly. Until then, much of what you “own” will keep working for someone else.

Disclaimer :This article is based on journalistic analysis and publicly observable industry trends. It does not constitute legal, financial, or investment advice.