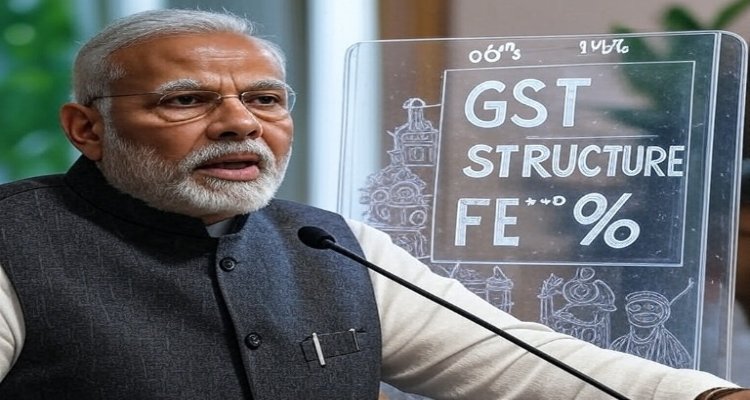

Govt Unveils Two-Slab GST Structure: A Landmark Move to Simplify India’s Tax Regime

India simplifies its GST regime with a new two-slab system of 5% and 18%, plus a special 40% rate for luxury items. Here’s what changes for consumers and businesses.

Introduction: A Simpler Road for Taxpayers

In a landmark reform aimed at easing complexities for consumers and businesses, the Government of India has rolled out a two-slab Goods and Services Tax (GST) structure. The decision, taken at the 56th GST Council meeting on September 3, 2025, introduces a simplified system with two key rates—5% and 18%—alongside a special 40% slab for luxury and demerit goods such as high-end cars, tobacco, and cigarettes. The new structure, set to take effect from September 22, 2025, is being hailed as one of the boldest tax reforms since GST was first introduced in 2017.

Background: India’s Journey Towards ‘One Nation, One Tax’

The Goods and Services Tax was launched in July 2017 after decades of debate, replacing a web of central and state levies with a uniform tax system. At the time of rollout, GST featured four major slabs—5%, 12%, 18%, and 28%—along with compensation cess on certain items. While the system was a step forward in harmonizing India’s indirect taxes, critics argued that multiple slabs created complexity for businesses and compliance challenges for small enterprises.

Prime Minister Narendra Modi, in his 2025 Independence Day address, promised a simpler structure that reduces disputes, boosts consumption, and enhances India’s competitiveness at a time when exports face steep tariffs globally. The latest GST revamp attempts to fulfill that pledge.

What Changed in the 56th GST Council?

Finance Minister Nirmala Sitharaman, who chaired the meeting, announced that all states unanimously supported the reform, signaling rare political consensus. The highlights include:

Key Rate Changes

-

5% Slab: Essential and common-use items like food products (butter, ghee, dry fruits, milk products, biscuits, cereals), medicines, and consumer essentials like soaps, toothpaste, and shampoos have moved into the lower slab, making them more affordable.

-

18% Slab: Broad-based rate for most goods and services, including cement, trucks, motorcycles (up to 350cc), and daily-use appliances like TVs and washing machines.

-

40% Special Slab: Reserved for luxury and demerit items such as large cars, SUVs, high-powered motorcycles, and sin goods like tobacco and cigarettes.

Major Relief Measures

-

Health & Life Insurance: Premiums on personal and family floater health and life insurance policies will now be exempted from GST, down from 18%.

-

Education Aids: Stationery items like erasers, maps, sharpeners, and exercise books are moved to nil tax category.

-

Auto Sector: Small cars (earlier taxed at 28%) will now attract only 18% GST, while trucks, three-wheelers, and goods carriers are shifted to the 18% bracket from 28%. Electric vehicles continue to enjoy a concessional 5% rate.

Expert Analysis: Why It Matters

Economists and tax experts see the move as a game changer for consumption-led growth.

“The two-slab GST structure lowers compliance burdens, reduces classification disputes, and broadens the affordability of everyday goods,”

said Dr. Sameer Mehta, tax policy analyst at ICRIER.

Small businesses are expected to gain from reduced paperwork, while consumers will feel relief in reduced costs of essentials and durables. Auto industry experts, however, caution that the 40% slab on large cars may dampen demand in the premium segment, though it strengthens the government’s social equity narrative of taxing the rich more.

Public Reaction: From Relief to Realignment

Early reactions from consumers and industry players have been mixed:

-

Middle-class households welcome lower prices on food staples, grooming products, and insurance premiums.

-

Health sector representatives lauded the exemption on medical insurance, calling it a “lifeline for financially vulnerable families.”

-

Auto manufacturers, however, warned that steep taxation on SUVs and luxury cars could impact long-term investments in India’s premium auto market.

On social media, many celebrated the reform as “common man–friendly,” while some critics flagged concerns about whether states would lose out on revenue and how the Centre would compensate them.

Broader Implications for the Economy

India remains a consumption-driven economy, with private consumption accounting for over 61% of GDP in FY2024-25. By slashing GST rates on consumer goods, the government aims to boost purchasing power, increase demand, and stimulate domestic industries.

Additionally:

-

Exports: Simplified GST invoices may improve compliance and reduce friction in international markets, critical as India counters a 50% U.S. tariff on certain exports.

-

Federal Relations: The unanimous decision indicates a rare moment of fiscal harmony, avoiding the usual Centre-state disputes.

-

Revenue Balance: The government will need to closely monitor how reduced rates impact GST collections, potentially relying on higher collections from luxury items to offset revenue gaps.

Conclusion: A Step Towards Simplification

The introduction of a two-slab GST structure represents one of the boldest tax reforms since independence. With a leaner system, the government has signaled its commitment to ease of doing business, consumer affordability, and transparent governance. While challenges around implementation and revenue balance remain, the reform sets India firmly on the path toward its long-standing vision of ‘one nation, one tax, one market.’

Disclaimer: This article is for informational purposes only. Readers should consult official government releases or tax experts for detailed guidance.