11 Years of Pradhan Mantri Jan Dhan Yojana: How India’s Biggest Financial Inclusion Drive Changed Lives

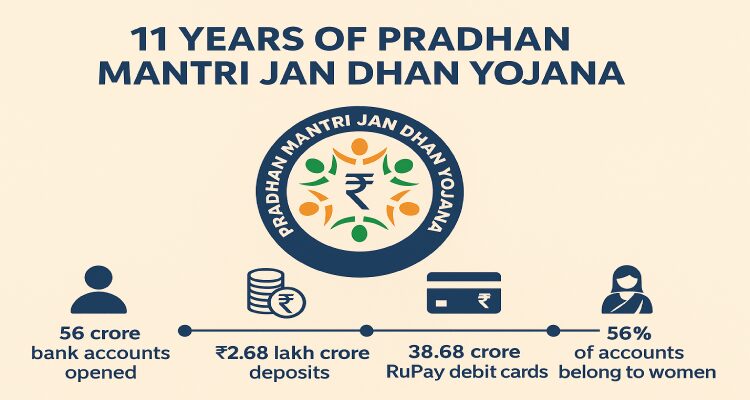

Celebrating 11 years of the Pradhan Mantri Jan Dhan Yojana, India’s largest financial inclusion program that has opened over 56 crore bank accounts and empowered millions.

Introduction: A Quiet Revolution in India’s Banking Story

On August 28, 2014, India launched an ambitious financial inclusion mission with a simple promise—every household should have a bank account. Eleven years later, the Pradhan Mantri Jan Dhan Yojana (PMJDY) has not only delivered on that promise but has also redefined how millions of Indians interact with money. With over 56 crore accounts opened and ₹2.68 lakh crore in deposits, the scheme has emerged as the backbone of India’s inclusive economic policies.

Prime Minister Narendra Modi called the initiative a movement that gave ordinary citizens “the power to script their own destiny.” For a nation where access to financial services was once a privilege, PMJDY has become a tool of empowerment.

Context & Background: Why Jan Dhan Was Needed

Financial exclusion has long been one of India’s silent challenges. According to Census 2011, only 58.7% of households had access to banking services. This meant millions of families depended on informal moneylenders, often at exorbitant interest rates.

Recognizing this gap, the government launched PMJDY as a National Mission on Financial Inclusion. Initially aimed at ensuring one account per household, the program soon shifted focus to providing every unbanked adult with access to a bank account. The model was designed around three key pillars:

- Banking the Unbanked – Zero-balance savings accounts with simplified KYC.

- Securing the Unsecured – Free RuPay debit cards with accident insurance cover.

- Funding the Unfunded – Access to micro-credit, micro-pension, and micro-insurance.

Main Developments: 11 Years of Transformation

The journey of PMJDY reflects India’s push toward inclusive growth:

- 56.16 crore bank accounts have been opened, bringing millions into the formal banking system.

- Deposits in these accounts have crossed ₹2.68 lakh crore.

- 38.68 crore RuPay debit cards have been issued, enabling cashless transactions.

- Women account holders represent 56% of total accounts, highlighting the scheme’s role in empowering women in the unorganised sector.

- Rural and semi-urban regions dominate with 67% of accounts, addressing the heart of India’s financial exclusion.

The scheme has become the foundation for major welfare initiatives like Direct Benefit Transfers (DBTs), PM-KISAN payments, MGNREGA wages, and emergency assistance during the COVID-19 pandemic. By cutting out middlemen, subsidies and benefits now reach beneficiaries seamlessly.

Expert Insight & Public Sentiment

Economists see PMJDY as one of the world’s largest social innovations. “No financial inclusion program has matched this scale and speed globally. It laid the rails for India’s digital payment revolution,” says financial analyst Ramesh Iyer.

Public sentiment echoes this view. For daily wage workers, farmers, and small vendors, Jan Dhan accounts have meant dignity and independence. Sita Devi, a farm laborer from Uttar Pradesh, recalls: “Earlier, we borrowed from moneylenders at high interest. Now my wages and government aid go directly into my account. I feel secure.”

Impact & Implications: Beyond Bank Accounts

PMJDY is not just about numbers—it has restructured India’s financial landscape.

- Catalyst for Digital India: With RuPay cards and UPI integration, Jan Dhan accounts have made India a global leader in real-time digital payments.

- Social Security Expansion: Schemes like Pradhan Mantri Suraksha Bima Yojana and Pradhan Mantri Jeevan Jyoti Bima Yojana rely on Jan Dhan accounts for coverage.

- Women’s Empowerment: Access to banking has enabled women to save, borrow, and build financial independence.

- Rural Growth Engine: With most accounts in rural and semi-urban areas, PMJDY has seeded financial literacy and self-reliance at the grassroots.

Looking ahead, experts suggest that PMJDY could evolve into a gateway for micro-credit expansion, green financing, and even AI-driven financial literacy programs.

Conclusion: A Blueprint for Inclusive Growth

As PMJDY marks 11 years, it stands as more than a banking scheme—it is a social contract of trust between the government and its citizens. From connecting the last village to powering India’s digital payment ecosystem, it has proven that financial inclusion is not charity but a catalyst for nation-building.

In Prime Minister Modi’s words, “When the last mile is financially connected, the entire nation moves forward together.” Eleven years on, the Jan Dhan Yojana remains India’s most powerful symbol of inclusive growth.

Disclaimer : This article is intended for informational purposes only. Readers are advised to verify figures and policy details with official government releases before making financial decisions.