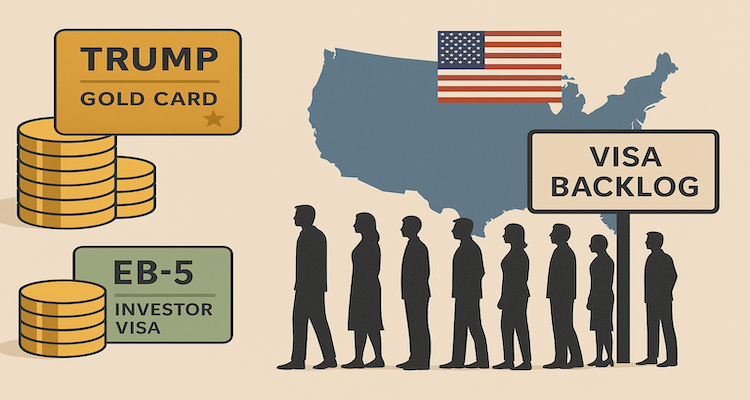

Trump Gold Card vs EB-5: What Indian Investors Must Know

The Trump Gold Card promises a premium U.S. residency path—but how does it really compare with the EB-5 visa for Indian investors? Here’s a clear breakdown.

A Golden Promise-or Just a Rebrand?

When headlines began circulating about the so-called “Trump Gold Card,” the idea immediately caught attention among global high-net-worth investors. Marketed as an elite gateway to U.S. permanent residency, the program appeared, at least on the surface-to offer a faster, cleaner route to a Green Card for those willing to pay a premium.

For Indian families with children studying, working, or planning long-term futures in the United States, the appeal is obvious. Any new pathway that hints at bypassing long visa queues naturally raises interest.

But immigration policy rarely rewards optimism alone. Once the branding fades, the real value of any program lies in its structure, costs, timelines, and legal realities. A closer look at the Trump Gold Card suggests it may be far less revolutionary than the marketing implies-especially when compared with the long-standing EB-5 Investor Visa.

This article breaks down how the Trump Gold Card actually works, how it compares with EB-5, and what Indian investors should carefully evaluate before committing substantial capital.

Why the Trump Gold Card Is Drawing Attention

The Trump Gold Card entered public discussion as a premium residency concept aimed at wealthy foreign nationals. Media coverage quickly framed it as a million-dollar fast track to a U.S. Green Card-an enticing narrative in an immigration system known for delays and backlogs.

For Indian applicants in particular, the timing matters. Employment-based visa categories like EB-2 and EB-3 continue to face years-long waits due to per-country caps. Any alternative that appears to reduce uncertainty or accelerate residency is bound to generate buzz.

However, the Trump Gold Card does not operate outside existing U.S. immigration law. Instead, it functions within established frameworks-an important distinction that shapes everything from eligibility to processing time.

How the Trump Gold Card Actually Works

Despite its premium branding, the Trump Gold Card begins much like other immigration pathways: with an online application and upfront fees.

Applicants are required to pay a non-refundable application fee of $15,000 per family member at the start. As the process advances, additional charges for processing, administrative services, and program-related costs apply. Some applicants report that the cumulative fees during the application flow can rise significantly, with figures exceeding $90,000 for a single applicant before residency is even considered.

At the center of the program is a $1 million payment, often described as the core requirement. Importantly, this amount is not an investment. It is a non-recoverable contribution, meaning there is no expectation of capital return under any circumstances.

Once fees, contributions, and associated costs are combined, the total financial commitment can be substantially higher than the headline figure suggests.

High Cost, Same Compliance Standards

One common misconception is that a higher price tag results in a lighter vetting process. In reality, Trump Gold Card applicants face the same rigorous compliance checks as any other U.S. immigration applicant.

Participants must thoroughly document the lawful source of funds, tracing capital through bank records, tax filings, business income, or inheritance documentation. This process mirrors the scrutiny applied under EB-5 and other investor-based pathways.

In addition, applicants must meet all standard U.S. admissibility requirements, including background checks and security reviews. The premium nature of the program does not reduce regulatory oversight.

In short, the Trump Gold Card demands more money-but not less documentation.

Does the Trump Gold Card Speed Up a Green Card?

This is where expectations and reality diverge most sharply.

While the Trump Gold Card is often perceived as a direct route to permanent residency, Green Cards are still issued through existing employment-based preference categories, such as EB-1 or EB-2. For Indian nationals, these categories are already subject to well-documented backlogs.

As a result, applicants may fulfill all financial and procedural requirements yet still wait years for final Green Card approval. The program does not bypass quota limits, nor does it create a separate allocation of immigrant visas.

For families planning education, careers, or permanent relocation, this distinction is critical. The Trump Gold Card does not eliminate waiting periods-it simply operates within them.

Trump Gold Card vs EB-5: A Side-by-Side Reality Check

The EB-5 Investor Visa remains the closest comparator-and in many ways, the more transparent one.

Under the current EB-5 framework:

-

The required capital investment is $800,000 for qualifying projects

-

Funds are structured as an investment, not a donation

-

Capital is generally returnable, subject to project performance and structure

-

Source-of-funds documentation and admissibility checks are mandatory

-

Compliance scrutiny is comparable to the Trump Gold Card

From a timeline perspective, EB-5 processing for Indian applicants is broadly aligned with other employment-based routes, particularly when rural or priority projects are involved.

The fundamental difference lies in capital treatment. EB-5 requires less money and offers the possibility-though not a guarantee-of capital recovery. The Trump Gold Card requires more money with no financial return.

The Key Question Indian Investors Should Ask

For Indian high-net-worth families, the decision ultimately comes down to a single question:

Is it worth contributing $1 million with no return when an $800,000 EB-5 investment follows a similar process, faces comparable timelines, and preserves capital potential?

There is no one-size-fits-all answer. Factors such as liquidity, risk appetite, family goals, and long-term residency plans all matter. But clarity, not branding-should guide the choice.

Why Due Diligence Matters More Than Ever

Immigration programs tied to political personalities or premium labels often generate excitement, but they also demand careful scrutiny. Residency decisions affect generations, not just balance sheets.

The Trump Gold Card may appeal to applicants prioritizing simplicity of structure over capital recovery. For others, EB-5’s lower threshold and investment-based model may remain more compelling.

What is clear is that neither option offers shortcuts around U.S. immigration law.

Look Past the Gold Finish

The Trump Gold Card adds a new name to the U.S. immigration conversation, but it does not rewrite the rules. It does not eliminate backlogs, reduce compliance burdens, or guarantee faster Green Cards-particularly for Indian applicants.

For investors weighing their options, the smartest approach is the most disciplined one: evaluate costs, timelines, legal pathways, and long-term outcomes with precision. In immigration planning, just as in investing, substance always matters more than shine.

(Disclaimer: This article is for informational purposes only and does not constitute legal, financial, or immigration advice. Immigration policies and interpretations may change. Readers should consult qualified immigration professionals before making decisions.)

ALSO READ: SBI Cuts Loan Rates After RBI Move, EMIs Set to Ease